State Tax Commission issues another order for Jackson County, this time for 2025 assessments

KANSAS CITY, Mo. (KCTV) - Just last week, Jackson County Executive Frank White, Jr, announced that property tax assessment increases for residential properties would be limited to 15 percent for 2025.

But the State Tax Commission is saying that’s not good enough. On Tuesday, the STC issued a new order. This one prohibits Jackson County from setting final 2025 assessment values without first correcting the 2023 and 2024 assessment values.

The STC’s ruling comes after White last week claimed, “the money from 2023 and 2024 is gone. It was spent to keep teachers in classrooms, keep fire trucks running, and keep services moving. What’s left now is to fix the system, not pretend we can go back in time.”

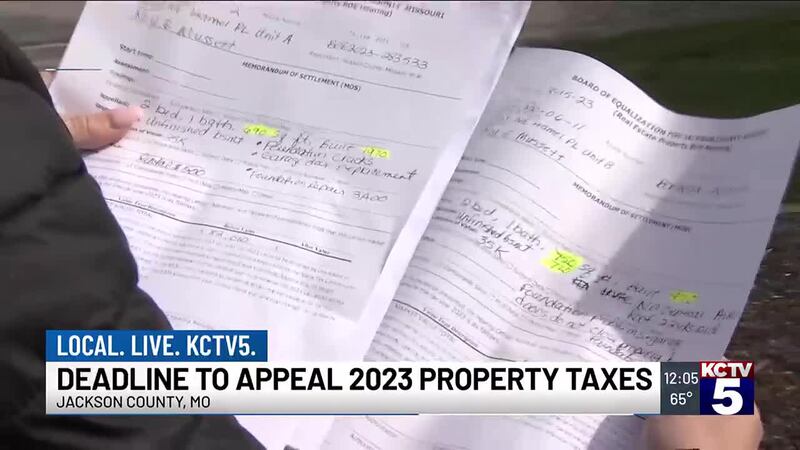

Earlier this month, a judge ruled that the STC acted lawfully when it ordered that increases to the 2023 and 2024 property tax assessments should be capped at 15 percent. The judge ruled the county did not follow the state law requiring a physical inspection of the property if the assessed value increased by more than 15 percent.

KCTV5 Investigates did numerous stories on the troubled assessment. Many homeowners told KCTV they feared losing their homes because they couldn’t pay the steep increases. Some saw their assessed values go up over 50 percent. More than 54,000 property owners filed appeals following the 2023 assessment.

But White has warned that capping assessments will ultimately result in tax burden shifts, and said that the money from those assessments is already spent.

“Taken as a whole, the Jackson County April 17, 2025, press release strongly suggests that Jackson County assessing officials still refuse to comply with the Commission’s 2024 Order by rolling back 2023 and 2024 residential assessments to their proper amounts,” the new STC order states.

The STC claims that an “erroneous baseline” is established for the 2025 assessments, unless the 2023 and 2024 assessments are rolled back to their proper amounts.

Tuesday night, White called the STC’s latest order shocking.

“They are trying to push through the same order the court already determined was unenforceable and do it while their appeal is still pending,” White said. “That’s not just shocking, it’s dangerous.”

White claimed the STC is preemptively attempting to block Jackson County from complying with Missouri laws.

“If the STC can arbitrarily change values and shift the tax burden on a whim, what stops them from raising your home’s value years after you’ve already paid your taxes?” said White. “That should scare every taxpayer, especially those who have been undervalued for years and may be forced to pay more years later.”

Copyright 2025 KCTV. All rights reserved.