Time is running out to act on 2023 Jackson County tax assessments appeals

KANSAS CITY, Mo. (KCTV) - Property owners who filed an appeal on their 2023 Jackson County property tax assessment have a limited amount of time to ensure they move forward in the county appeals process.

The deadline to file a new appeal has long since passed — the end of 2023 — but the estimated 54,000 existing appeals must be acted on by April 30, 2025, or they will not be reviewed by the Jackson County Board of Equalization (BOE). Instead, they will be passed straight to the State Tax Commission.

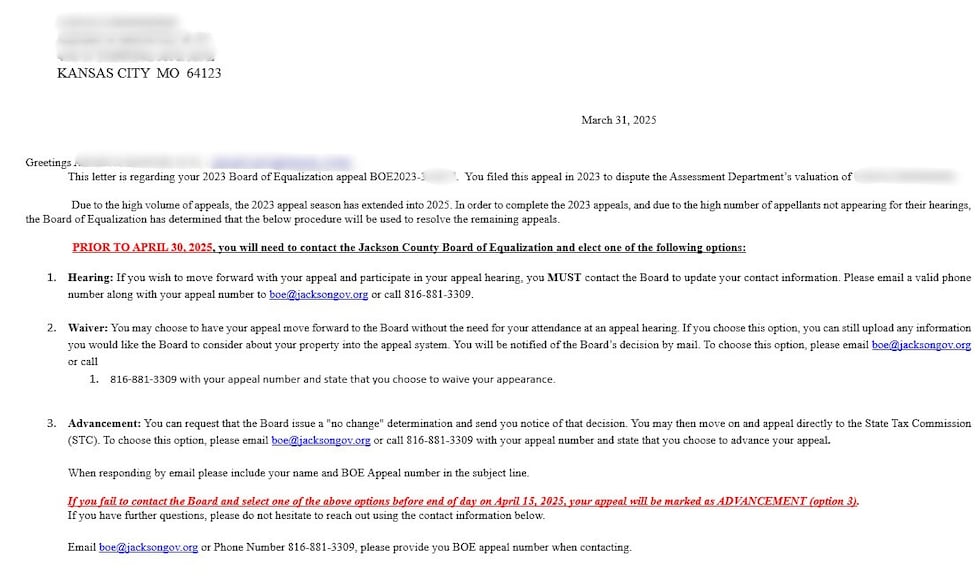

At the end of March 2025, property owners participating in the 2023 appeals process received the following email, prompting them to choose how they wanted to proceed by the deadline of April 30, 2025.

As outlined in the email, there are three options:

- Hearing: Request a formal hearing with the BOE.

- Waiver: Waive the right to a formal hearing with the BOE, but allow them to review the appeal and send a decision via mail.

- Advancement: Request that the BOE mark the appeal as “no change,” as in make no adjustment to the 2023 tax assessment, and pass the appeal on to the State Tax Commission.

All three options require property owners to contact the BOE directly, either by emailing boe@jacksongov.org or by calling 816-881-3309 with their appeal numbers. Anyone who does not respond by the deadline will have their appeal marked as “advancement,” meaning there will be “no change” through the BOE.

Anyone needing assistance with this matter can contact the BOE at boe@jacksongov.org or 816-881-3309.

Legislator Manny Abarca expressed dissatisfaction with the way the BOE handled this portion of the appeals process.

“I am upset with the fact that it’s clear the process of [emailing] taxpayers instead of providing true communication. For the County to ask them to renew their request for relief was a means for dismissal of their case is unforgivable,” Abarca said.

KCTV5 reached out to a representative of Jackson County for clarification on how property owners were notified that they needed to take action by April 30, but has not yet heard back.

Click here to read more KCTV5 Investigates reporting on the Jackson County Tax Assessment Troubles.

Copyright 2025 KCTV. All rights reserved.