Jackson County lawyer: One way or another, court order on assessments will be challenged

KANSAS CITY, Mo. (KCTV) - A state order to roll back assessments is unconstitutional and harmful. That’s the assertion the county’s chief lawyer, County Counselor Bryan Covinsky, made Monday.

He made the statements at a news conference with Jackson County Executive Frank White, County Assessor Gail McCann Beatty, Deputy County Assessor Maureen Monaghan, and County Administrator Troy Schulte.

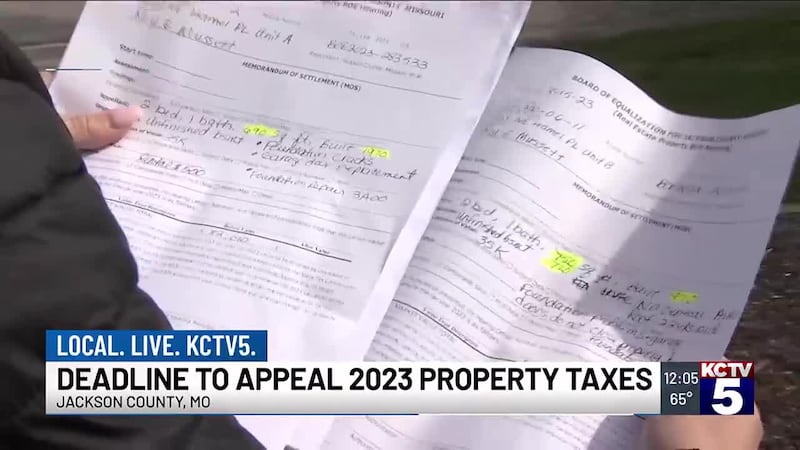

Many homeowners were hit with assessments that more than doubled. State law specifies rules about physical inspections for properties with increases above 15%. The State Tax Commission (STC) ruled the county failed to do thorough inspections on many of them and subsequently ordered the county to reduce the assessments to no more than 15% across the board.

WHO WINS?

Schulte sent a clear message that it is not the victory for the little guy that some are hailing it to be.

Assessments are not the same as property taxes. Property taxes are calculated by multiplying the assessed valuation by the levy set by the jurisdictions that get the property tax revenue. Those jurisdictions each set their own levies. School districts get the most. When the assessments skyrocketed, they lowered their levy because state law does not allow them to get a windfall. If the county abides by the STC’s order, districts will need to raise their levies significantly to compensate.

“I want to disabuse people that they’re going to get some lovely refund check because of this egregious error,” Schulte said. “It’s not going to happen. In most cases, you’re going to pay a lot more.”

That’s particularly true for the people who saw smaller increases. Their assessments won’t change, so that higher levy will apply to their existing assessed valuation. There’s little doubt they would see their property tax bills increase.

Those who saw increases above 15% would get a decrease in their assessed valuation if the order is followed, so they could ostensibly see a reduction from their most recent bill depending on how much the order decreases their assessed valuation from what they were previously assessed.

County legislator Sean Smith sees that outcome as fair, because, he says, the people with the highest jumps are the ones who were wronged.

“Who this is saving are the people improperly and illegally assessed with very, very large increases,” Smith said. “Those are the people that we really harmed.”

The order applies regardless of whether the assessment increase was appealed or appealed successfully.

WHY FIGHT IT?

The county’s executive branch is vowing to fight the order, which they have described as unconstitutional. They haven’t yet specified how.

In Monday’s meeting of the county legislature, Covinsky said if the county does not fight the order, they are setting themselves up to be sued by the school districts and other jurisdictions impacted.

In the news conference, he said he plans to enlist those entities to challenge the STC.

“We are going to go forward the best way we can to figure out what the legal challenge will be,” Covinsky said. “But we’re going to be working with the subdivisions that have actually been harmed by this decision. That’s done retroactively. That will affect the future of their budgets, as well as what is coming up to be made at the end of September.”

That deadline is fast approaching. It’s six weeks away. It’s for that very same reason that Smith said a fight will do districts more harm than good. It’s hard to set a budget and a levy when the assessment rolls remain unknown. He contends the next six weeks are better spent finding a fix than taking a gamble.

“The level of uncertainty that exists because the administration wants to be obstinate and deny a lawful order is causing those taxing jurisdictions to not know, do they need to bump their levies back up and implement the cap, or if the county is going to fight this and be successful?” he said.

He said he had a conversation with leaders at the Lee’s Summit School District and they were amenable to an idea he proposed.

When they raise levies this fall to account for the change, they can likely raise them enough to also recoup what they’ll have to pay back for the previous tax year.

He suggested that the county then allow them to spread out the amount owed to the county over two years. He suggested the county resolve things similarly for the property owners by applying a credit spread over two years or cycles.

Nothing has been proposed officially.

PENDING IN THE LEGISLATURE

Smith submitted a resolution directing the county counselor not to appeal the STC ruling. The resolution also included an instruction that the legislature have input on any lawsuit over $5,000.

It didn’t make it to a first reading. Legislative chair Jeanie Lauer rejected it due to concerns about whether it was legal.

Another matter related to the assessor’s office is just one vote away from going on the November ballot.

Weeks ago Legislator Manny Abarca submitted an ordinance that would place a measure on the November ballot for voters to decide whether to make the position of assessor an elected office.

A narrow majority vote of 5-to-4 allowed it to be moved to next Monday’s meeting for a final vote. Those opposed were Lauer, Vice Chair Megan Marshall, Jalen Anderson, and Charlie Franklin. The state deadline for final certification of the November ballot is August 27.

RELATED NEWS: Homeowners worry they’ll lose their home because of 2023 property tax assessment

To get the latest news sent to your phone, download the KCTV5 News app here.

Copyright 2024 KCTV. All rights reserved.