Skip to content

Updated: Apr. 30, 2025 at 3:17 PM CDT

|By Zoë Shriner

Jackson County property owners who are in the appeals process for their 2023 tax assessments have until April 30 to take action.

Updated: Apr. 22, 2025 at 4:55 PM CDT

|By Cyndi Fahrlander

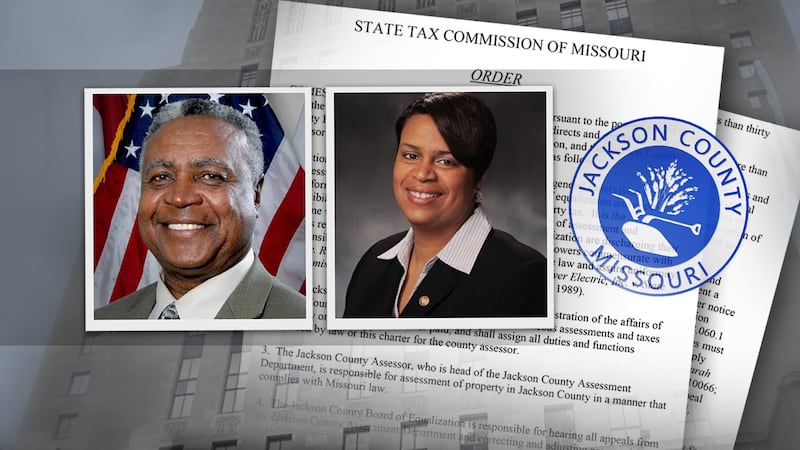

The State Tax Commission is saying that’s not good enough to Frank White's latest ruling on property tax assessments.

Updated: Apr. 18, 2025 at 10:47 PM CDT

|By Betsy Webster

“A final decision has not yet been made, but we cannot and will not implement this ordinance while these fundamental questions remain unresolved,” White’s veto message read.

Updated: Apr. 18, 2025 at 5:23 PM CDT

|By Samantha Boring

Jackson County announced it is capping 2025 tax assessment increases at 15 percent, but homeowners want to see more done with the troubled 2023 assessments where all of this started.

Updated: Apr. 17, 2025 at 10:43 PM CDT

|By Betsy Webster

The order comes on the heels of a troubled assessment, which KCTV5 Investigates covered doggedly.

Updated: Apr. 17, 2025 at 4:17 PM CDT

|By Cyndi Fahrlander and Samantha Boring

Property tax assessment increases for residential properties in Jackson County will be limited to 15 percent for 2025.

Updated: Apr. 7, 2025 at 10:52 PM CDT

|By Betsy Webster

A slim majority of Jackson County legislators on Monday passed an ordinance regarding the property tax assessments.

Updated: Apr. 2, 2025 at 10:41 PM CDT

|By Betsy Webster

Fowler sponsored HB 999 with the support of other lawmakers representing Jackson County. The bill would give the state leverage to enforce orders.

Updated: Apr. 1, 2025 at 4:32 PM CDT

|By Greg Dailey and Samantha Boring

The ongoing tax debacle in Jackson County took a significant turn on Tuesday.

Updated: Mar. 31, 2025 at 5:48 PM CDT

|By Cyndi Fahrlander

Another trial is underway over the Jackson County property tax assessments.

Updated: Feb. 10, 2025 at 12:37 PM CST

|By Nathan Brennan

The ordinance would require the Jackson County assessor to roll back assessments with more than a 15% increase from 2022 to 2023. Legislators have also discussed a resolution requiring photos and sale comparisons to be posted on updated assessments.

Updated: Jan. 23, 2025 at 5:33 PM CST

|By Cyndi Fahrlander

After three days, testimony in the bench trial over the 2023 Jackson County tax assessment has ended.

Updated: Jan. 22, 2025 at 5:25 PM CST

|By Cyndi Fahrlander

The trial over the 2023 tax assessment is on its second day.

Updated: Jan. 21, 2025 at 3:31 PM CST

|By Cyndi Fahrlander

The state argued that the assessment was flawed and that the county didn’t follow the law.

Updated: Jan. 15, 2025 at 5:46 PM CST

|By Cyndi Fahrlander

Bench trial on 2023 Jackson County property tax assessment moves foreward

Updated: Dec. 23, 2024 at 3:43 PM CST

|By Cyndi Fahrlander

The court battle over the 2023 property tax assessment has yet to be resolved, and already, there’s fighting over the 2025 property tax assessment plan.

Updated: Nov. 25, 2024 at 5:59 PM CST

|By Cyndi Fahrlander

A judge has set a January 13 trial date to hear arguments in the 2023 Jackson County property tax assessment.

Updated: Nov. 22, 2024 at 9:27 AM CST

|By Cyndi Fahrlander

Despite claims of victory from County Executive Frank White, the court battles over the 2023 property tax assessment are not over.

Updated: Nov. 20, 2024 at 5:16 PM CST

|By Sarah Motter

Jackson County leaders will continue property tax assessment reforms as a lawsuit filed by the Missouri Attorney General has been permanently closed.

Updated: Nov. 15, 2024 at 5:35 PM CST

|By Cyndi Fahrlander

A Jackson County attorney has filed a class action countersuit claiming thousands of Jackson County property taxpayers are still waiting to be heard in court.

Updated: Sep. 23, 2024 at 10:44 PM CDT

|By Betsy Webster

Two legislators who have been among the most outspoken critics of the process presented a new plan to try to save taxpayers some money.

Updated: Sep. 23, 2024 at 7:28 PM CDT

|By Jiani Navarro

Last month, the Missouri State Tax Commission capped the county’s property values at 15% for the 2023 and 2024 assessments.

Updated: Sep. 4, 2024 at 8:36 PM CDT

|By Gabe Swartz

Jackson County filed a legal challenge against the Missouri State Tax Commission’s order on Wednesday, arguing the move was highly politicized and unprecedented.

Updated: Aug. 20, 2024 at 11:12 PM CDT

|By Betsy Webster

The fight over Jackson County property taxes isn’t going away.

Updated: Aug. 19, 2024 at 10:31 PM CDT

|By Betsy Webster

Jackson County voters could get a chance to decide whether the position of assessor should be elected instead of appointed, but it will only happen if Jackson County Executive Frank White allows it.

Updated: Aug. 13, 2024 at 6:36 PM CDT

|By Samantha Boring

Last week, the Missouri State Tax Commission (STC) ordered the county must limit assessment increases in 2023 to 15% in most cases.

Updated: Aug. 13, 2024 at 6:40 AM CDT

|By Betsy Webster

A state order to roll back assessments is unconstitutional and harmful. That’s the assertion the county’s chief lawyer made Monday.

Updated: Aug. 12, 2024 at 7:17 PM CDT

|By Grace Smith (KCTV5)

Thousands of Jackson County residents are frustrated as county leaders say there will be no refunds in the 2023 property tax assessment. County leaders said the money has already been spent. This comes after the State Tax Commission ordered the county to fix the assessment.

Updated: Aug. 12, 2024 at 3:45 PM CDT

|By Angie Ricono and Cyndi Fahrlander

The county administrator said the action by the State Tax Commission does not fix the problem, and ultimately, taxpayers will have to pay more.

Updated: Aug. 12, 2024 at 12:32 PM CDT

|By Greg Dailey

The STC ordered the county to correct the 2023 assessment and ordered increases in valuation be capped at 15% for 2023 and 2024.

Updated: Aug. 9, 2024 at 5:40 PM CDT

|By Angie Ricono and Cyndi Fahrlander

It’s been days since the Missouri State Tax Commission (STC) put its proverbial foot down on the Jackson County property tax assessment, but it seems it is no closer to a resolution with the county.

Updated: Aug. 9, 2024 at 8:00 AM CDT

|By Cyndi Fahrlander

The legal case involving Jackson County property taxes has been dismissed by a judge.

Updated: Aug. 8, 2024 at 10:44 PM CDT

|By Betsy Webster

An order this week from the Missouri State Tax Commission could create a serious strain for those counting on property tax dollars to run.

Updated: Aug. 8, 2024 at 5:50 PM CDT

|By Angie Ricono and Cyndi Fahrlander

The tax commission ordered those increases be capped at 15%, for 2023 and 2024.

Updated: Aug. 7, 2024 at 9:29 PM CDT

|By Gabe Swartz and Angie Ricono

After the Missouri State Tax Commission ordered Jackson County to fix some 2023 property tax assessments, a motion has been filed to dismiss a lawsuit against the county.

Updated: Aug. 7, 2024 at 9:11 PM CDT

|By Angie Ricono and Cyndi Fahrlander

Thousands of Kansas City property owners appealed to the tax commission after their appeals to the county’s Board of Equalization failed.

Updated: Aug. 5, 2024 at 5:18 PM CDT

|By Gabe Swartz

A change to Missouri legislation has led Jackson County to announce updates to its Senior Property Tax Credit Program.

Updated: Jul. 22, 2024 at 10:31 PM CDT

|By Betsy Webster

Jackson County lawmakers have two big issues they want on the November ballot.

Updated: Jul. 9, 2024 at 6:33 PM CDT

|By Grace Smith (KCTV5)

Heated homeowners are calling for some accountability after Jackson County Assessor Gail McCann Beatty took the stand in the 2023 tax assessment trial.

Updated: Jul. 8, 2024 at 5:46 PM CDT

|By Grace Smith (KCTV5)

Data analyst Preston Smith spent much of the day on the witness stand as the Jackson County tax trial continues.

Updated: Jun. 28, 2024 at 4:20 PM CDT

|By Angie Ricono

Friday was the second day for testimony in the Jackson County property tax trial.

Updated: Jun. 27, 2024 at 12:39 PM CDT

|By Angie Ricono

A judge is now hearing testimony regarding the 2023 Jackson County property tax assessment.

Updated: Jun. 4, 2024 at 5:39 PM CDT

|By Cyndi Fahrlander

A Jackson County judge has delayed the trial in the lawsuit filed over the latest Jackson County tax assessment.

Updated: Jun. 3, 2024 at 5:38 PM CDT

|By Angie Ricono and Cyndi Fahrlander

Despite the county’s efforts to have the case thrown out, the lawsuit over the latest Jackson County property tax heads to court on Thursday.

Updated: May. 15, 2024 at 3:58 PM CDT

|By Greg Dailey

The statement cited financial risk for school districts and essential public services.

Updated: Apr. 29, 2024 at 9:15 PM CDT

|By Gabe Swartz

Missouri Attorney General Andrew Bailey announced Monday that he’s opening a tip line for victims of Jackson County’s tax assessment troubles.

Updated: Apr. 10, 2024 at 4:02 PM CDT

|By Gabe Swartz

Jackson County said Wednesday it plans for a 'soft launch reopening' of county offices next week.

Updated: Apr. 3, 2024 at 4:47 PM CDT

|By Gabe Swartz

Jackson County is keeping its Assessment, Collection and Recorder of Deeds offices closed for the remainder of the week as the County continues its efforts into investigating a ransomware attack.

Updated: Apr. 2, 2024 at 6:34 PM CDT

|By Samantha Boring

On Tuesday, Jackson County confirmed a ransomware attack disrupted several county services, including the Jackson County Assessment Department.

Updated: Mar. 6, 2024 at 1:12 PM CST

|By Joe Hennessy

Jackson County property taxpayers continue working to get their documentation handled, but it’s still taking hours to complete.