Jackson County’s 2025 tax assessments to cap at 15%, but is that enough?

KANSAS CITY, Mo. (KCTV) - A property tax assessment announcement Thursday from the office Jackson County Executive Frank White, Jr. was greeted by some as a victory and by others as a stall tactic.

The announcement attributed jointly to White and County Assessor Gail McCann Beatty indicated that “residential property assessment increases in 2025 will be limited to no more than 15%.”

The move was a response to an August 2024 order from the Missouri State Tax Commission (STC) that the county retroactively cap increases in the 2023/2024 cycle at 15%. The county does assessments every two years then bills annually.

The news release issued Thursday -- without any opportunity for follow-up questions or interviews -- indicated the decision was made after consulting with legal counsel and subject matter experts.

Putting a cap on the 2025 increases might be a nod to the order, but it is not the same as complying with the order. White addressed that in the statement.

“The truth is simple: the money from 2023 and 2024 is gone. It was spent to keep teachers in classrooms, keep fire trucks running, and keep services moving,” said White. “What’s left now is to fix the system, not pretend we can go back in time.”

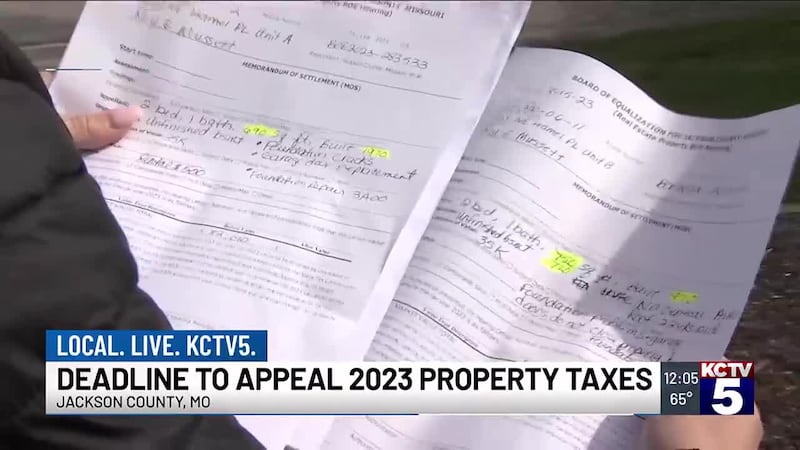

The order came on the heels of a troubled assessment which KCTV5 investigates covered doggedly.

The STC determined, in part, that the county did not perform sufficient exterior inspections or provide timely notice of a right to interior inspections for residential properties that saw an increase in excess of 15%. As a result, the STC ordered the county to lower assessed valuations to no more than 15% above the previous year.

McCann Beatty Thursday reiterated a sentiment she expressed in the past.

“As I told the STC last year, this is unprecedented,” McCann Beatty said in a written statement. “And now we’re being forced to make policy on unstable legal ground with property owners stuck in the middle.”

The statement did not clearly state if the county will or won’t comply with the STC order on the 2023 assessment.

“County officials will continue evaluating recent legislative proposals and litigation outcomes and will provide additional information as developments emerge,” a portion of the lengthy statement read.

LEGISLATORS RESPOND

Some county legislators raised concern back in 2023, just a month after notices went out. Vocally critical legislators like Manny Abarca and Sean Smith proposed numerous ordinances and resolutions.

Abarca on Thursday hailed the announcement as a victory.

“I think this is vindication for taxpayers for at least ‘25 and ‘26,” Abarca said. “It’s also a sign to say that the ‘23 lawfulness is very much in question if he is taking this position now for 2025.”

Smith was more worried than encouraged.

“I could read this and say, ‘OK, they realize that they shouldn’t do such large increases at once,’” Smith remarked. “You could argue that’s a victory, but having seen what I’ve seen from this administration, this is not them conceding. This is them avoiding.”

He described prolonged battle as one in which the administration kicked the can down the road then decried that the eventual STC order came too late for the county to address retroactively.

Both legislators expressed concern about whether the administration would continue to fight the STC order in court. Various lawsuits have ensued. In one, the administration argued the STC order was unlawful and a judge disagreed on all counts.

Over time, a clear voting block among the nine-person legislature pitted Abarca, Smith and three others against a block of four. That frequently led to 5-4 votes that could be vetoed by White. Legislator Donna Peyton has sided with Smith and Abarca. She has a more optimistic response to the 2025 assessment announcement.

“The County Executive’s decision represents a commitment by Jackson County to keep Jackson County a place where families can thrive without being burdened by unreasonable tax increases,” Peyton said in a written statement.

TAX COMMISSION RESPONDS

The STC issued a response to the announcement touching on present, past and future.

It said it was “pleased to learn of the apparent decision by Jackson County” to cap 2025 increases.

It then cast doubt on whether the administration had any intention to follow the order regarding the 2023 increases.

“Unfortunately, it appears that the County will continue to refuse to comply with the Commission’s Administrative Order issued last August,” the STC statement continued.

It said it “continues to seek judicial enforcement of its Order pertaining to the 2023 assessment increases.”

UPDATE: KCTV5 previously reported the deadline for White to veto the county ordinance was April 17. It is possible he has until April 18 as the deadline is based on when the ordinance was presented to the county executive, not on when the ordinance passed.

WHAT’S NEXT

On April 7, the legislature passed an ordinance ordering the administration to comply with the STC order. The 5-4 vote was not veto-proof.

The county charter indicates the executive has 10 days after being presented with the ordinance to veto. Smith indicated the deadline would be April 17.

Abarca later clarified that would be the deadline only if it was presented to White on the day it passed. If he received the ordinance the day after, which Abarca said has happened on the past, the deadline would be April 18. As of 10 p.m. on April 17, no veto notice had been announced.

Copyright 2025 KCTV. All rights reserved.