Frank White’s foes in legislature reveal new effort in property tax battle

KANSAS CITY, Mo. (KCTV) - The troubled property tax assessment process in Jackson County has resulted in much sniping in the county legislature. On Monday, the two legislators who have been the most outspoken critics of the process presented a new plan to try to save taxpayers some money.

They want to lower the levy for the county’s general fund.

“At least for the portion that we can control, I think we need to be willing to take a significant haircut and really do what we can what’s within our authority as a legislative body to minimize the harm that we’ve caused to so many taxpayers,” said Republican legislator Sean Smith.

Smith and Democrat legislator Manny Abarca have become vocal adversaries of County Executive Frank White, who hired the beleaguered director of assessments.

The pair gathered ahead of hearings for the levies set by the county to discuss their plan and cry foul of the situation leading up to it.

They want to lower the county’s general fund levy to ease the burden placed on homeowners whose assessments skyrocketed, but the impact on individual homeowners is limited.

LIMITS TO THE PLAN

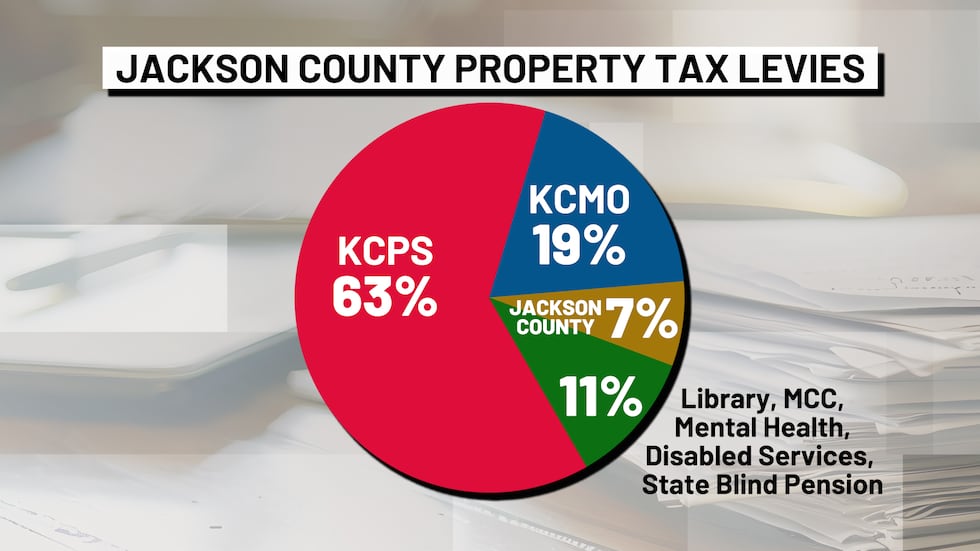

A tax bill is broken down into several levies, each controlled by different entities. The vast majority goes to school districts. The county can’t control its levy. Another big chunk goes to the city, which has control over its levy. Other entities include libraries and community colleges.

ALSO READ: Jackson County legislators call out county administration over property taxes

For those who live in the Kansas City School District, the county general fund amounts to about 7% of property tax bills. That is the piece of the pie being considered for a cut.

KCTV5 looked at a small house valued at $180,000. The county general fund amounted to $175 of a $2,674 tax bill.

The county controls two other — much smaller — levies for mental health and disabled services. On Monday, the legislature approved the levies suggested for those.

When it came time to vote on the general fund levy, five of the nine legislators cast a vote to hold the measure until the next meeting. That gives them time to research and craft a proposal for a lower amount.

“What would normally be a very basic, very rubber stamp process, now can be flipped on its head and actually provide relief nearly immediately,” said Abarca.

REASON FOR THE MOVE

Those two legislators and some less outspoken allies on the legislature have been upset with the assessment process and the steep hikes. Some saw their assessed valuations double or triple.

KCTV5 Investigates revealed that many of them did not come with inspections at the standard required by state law.

Abarca and Smith have proposed resolutions and ordinances to address that, but they’ve been stymied.

ALSO READ: Jackson County files legal challenge against State Tax Commission’s order

The state tax commission ordered the county to lower some assessments. County administration filed a lawsuit to fight it. The legislature prepared a ballot measure that would make the assessor an elected position. The county executive vetoed it.

Smith provided ordinance language, calendar entries and emails for related legislation he submitted weeks ago that has yet to get the legal department’s approval to go on the agenda.

“The other side of the building, the county executive and the county counselor, should have no power to prevent legislation from coming before the legislature on a timely basis, but that is the exact type of legislative interference that they are conducting on a regular basis,” Smith said.

TIMELINE FOR CHANGE

County lawmakers now have a week to decide what dollar amount to submit for a vote, based on what’s financially feasible and what’s politically feasible.

They secured five votes to hold the measure to next week. They need six votes for a veto-proof majority but only five to pass it. The move to hold sets up a timeline beneficial to those who would like to see the plan advance.

That next meeting is on Sept. 30. The state deadline to set a levy is Oct. 1. That could preclude a veto.

Smith said a veto without time to go back to the drawing could put White afoul of state law.

For more reports on the Jackson County Tax Assessment, click here.

Copyright 2024 KCTV. All rights reserved.