Jackson County files legal challenge against State Tax Commission’s order

KANSAS CITY, Mo. (KCTV) - Jackson County filed a legal challenge against the Missouri State Tax Commission’s order on Wednesday, arguing the move was highly politicized and unprecedented.

The order, issued in early August, required the county to limit assessment increases in 2023 to 15 percent in most cases. In its legal challenge, Jackson County called it unlawful and said it was “filled with factual inaccuracies.”

“It was issued on the same day the Attorney General won his August primary election,” the county said in a release shared Wednesday night. “If implemented, the order would undermine fair and accurate property assessments and jeopardize the essential services that residents rely on daily.”

The petition, filed by the county with support from county assessor Gail McCann Beaty and county executive Frank White Jr., claims the order:

- Violates Missouri’s state constitution

- Goes beyond the agency’s legal authority

- Is not backed by actual evidence

- Is illegal and issued improperly

- Is unjust and unreasonable

- Shows an abuse of authority

“We believe the State Tax Commission’s order is not only misguided and dangerous, but also violates state law and constitutional standards,” said White Jr. “This legal challenge is about ensuring that the assessment process remains fair, transparent and in line with the law. We are committed to defending our procedures and the work that has been done.”

READ MORE: ‘Devastating’: What rolling back property tax assessments could mean for schools

The county claimed inaccurate and inconsistent property assessments dated back decades, leading the STC to repeatedly direct the county to increase valuations to comply with state law requirements. It claims, as a result, extra help was brought in to assist the county with the 2023 reassessment.

“State law requires properties to be assessed at their true market value, which we’ve worked hard to achieve,” said County Assessor Gail McCann Beatty. “While the process has been challenging, it’s essential for a fair and just tax system. This effort ensures that everyone in Jackson County is treated equitably, regardless of where they live, who they know or how much their home is worth.”

ALSO READ: $356,270 is Jackson County’s favorite assessment number. Why that might be wrong.

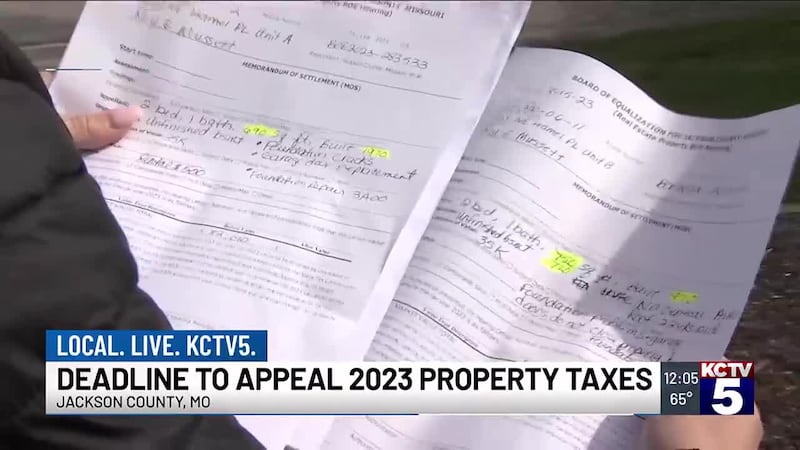

Nearly 55,000 appeals -- a record -- were filed in Jackson County in 2023. Homeowners have described a broken process and some have shared worries they’ll lose their house as a result. In December, the state auditor revealed problems with state-required physical inspections and required notifications.

Shortly after the State Tax Commission issued its order, Missouri Attorney General Andrew Bailey filed a motion to dismiss his tax assessment lawsuit against Jackson County. Two days later, a judge dismissed the lawsuit.

Read the county’s petition here:

Jackson County tax assessment petition by gswartz00 on Scribd

For more coverage of the tax assessment trouble from KCTV, click here.

Copyright 2024 KCTV. All rights reserved.