Judge rules against Jackson County over troubled property tax assessments

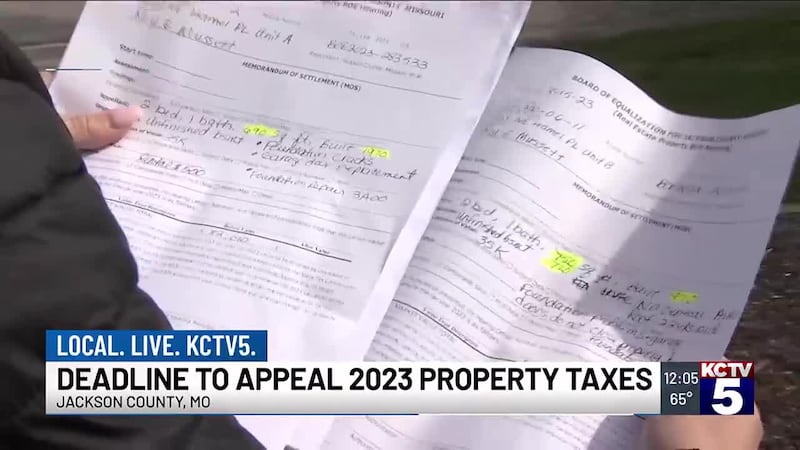

KANSAS CITY, Mo. (KCTV) - The ongoing tax debacle in Jackson County took a significant turn on Tuesday.

A judge sided with the State Tax Commission, stating it acted lawfully in August 2024 when it ordered that increases to 2023 and 2024 tax assessments should be capped at 15 percent.

“Taxpayers deserve this judgment I’m going to do everything in my power to make sure it sticks,” said Jackson County Legislator, Manny Abarca.

Jackson County Assessor Gail McCann Beatty said she did not know what the results would be with the order and did not offer much of a comment on the ruling.

In the judgement, it states ‘Jackson County Petitioners failed to provide adequate notice to approximately 75% Jackson County real property owners who faced increases of 15% or more; that the Jackson County Petitioners sent notices to property owners about interior inspections which misstated the applicable law’

“It is not factual we absolutely sent notices out to every single person in the county they were given the opportunity for the interior inspection if they wanted it. We completed over 4,000 inspections and so I don’t agree that that was the case, and so we will see where we go from here that is all I have to say for right now,” said Jackson County Assessor Gail McCann Beatty.

Jackson County Legislator Sean Smith called for McCann Beatty, her senior staff, County Executive Frank White Jr., and the County Attorney to resign after this ruling came down.

”When you do things wrong like this it is okay you gotta fix it, but when you insist that it is right and let it linger like it has for over two years we start to create some consequences that potentially can’t be unwound," said Legislator Smith.

McCann Beatty said she would absolutely not resign.

“I came here to do a job and that was to get our county where it needs to be and that is what I came here to do and that is what I’m doing,” said McCann Beatty.

Legislator Smith said this is going to be extremely complex and costly.

On Tuesday, KCTV5 Investigates spoke with Jonathan Soper, who is the attorney on a class action lawsuit for taxpayers disputing tax assessments.

“It is a recognition from the court that the state tax commission was acting in its authority when it entered the order in August 2024,” said Humphrey Farrington & McClain Attorney Jonathan Soper.

He believes this will be appealed to the Missouri Supreme Court. As for school districts and local governments that rely on this funding, he said there are policies try and fix the problem.

“Depending on what the Supreme Court decides, there are laws and procedures in place for this type of situation where property is overvalued and then a decision on the appeal comes out, which lowers the value of the property to the extent that affects funding for school districts and other taxing entities. There are procedures to correct that,” said Soper. He added, “So that the schools and other tax jurisdictions are properly funded but at the same time folks are paying their fair share and only their fair share.“

He is hopeful this will bring relief for taxpayers, but expects many more steps ahead.

Legislator Abarca called for a special meeting after the order came down.

“Now we finally see the justice system working for taxpayers in Jackson County. It is important you finally see that Frank White is going to have to relent tot his battle that he has led against the State Tax Commission,” said Legislator Abarca. He added, “I think what you are going to see is folks in this building and the administration trying their best to find a legal argument to keep this going.”

Jackson County Legislator DaRon McGee said he wants to see the administration ‘do the right thing and follow the law.’

Jackson County released a statement after the judgement in part quote:

Jackson County acknowledges the recent decision by a state court judge regarding the State Tax Commission’s (STC) August 2024 order. Despite the court’s finding in this case, that same order had previously been ruled unenforceable in a separate proceeding. The inconsistency between rulings highlights the complexity of the situation and underscores why the County is carefully determining its next steps.

The STC issued its order more than a year after Jackson County completed its state-mandated 2023 reassessment, and nearly a year after property taxes had already been billed, collected, and distributed to cities, schools, fire districts, and other essential services. The STC order was issued without a hearing, without notice to the County, and was based on inaccurate information. Many of the same claims were already rejected in court when the Missouri Attorney General’s lawsuit against the County was dismissed with prejudice.

Even if the County were in agreement with the order, unwinding the 2023 assessments would have significant and unequal consequences. Revisiting assessments now could cause some residents, particularly those in neighborhoods that haven’t appreciated as rapidly, to pay more in taxes than the actual market value of their homes would justify.

The Missouri Attorney General, Andrew Bailey, shared: “Today’s ruling ensures that the people of Jackson County will not be subjected to illegal tax hikes,” said Attorney General Bailey. “We will continue to fight for fairness and accountability to ensure local officials aren’t breaking the law and exploiting working Missouri families in Jackson County.”

He said this is just a legal viturey and leaves real consequences for Jackson County and its taxpayers.

This comes as the Missouri State Auditor continues to try and audit Jackson County property tax assessments. He shared on X “”I commend the court for affirming the State Tax Commission’s authority and the validity of the preliminary results my office released in December of 2023 that outlined how the Jackson County Assessment Department failed to comply with state law and victimized homeowners in Jackson County with a flawed and inadequate assessment process...This has been a long and drawn out saga for the people of Jackson County and they deserve for this to come to an end with a resolution that protects them from the illegal tax increases they received."

Editor’s Note: This is a breaking news story and will be updated.

For more reports on the Jackson County Tax Assessment, click here.

Copyright 2025 KCTV. All rights reserved.