Jackson County’s second property tax assessment trial begins

KANSAS CITY, Mo. (KCTV) - The bench trial over the 2023 Jackson County property tax assessment opened this morning at the Jackson County Courthouse.

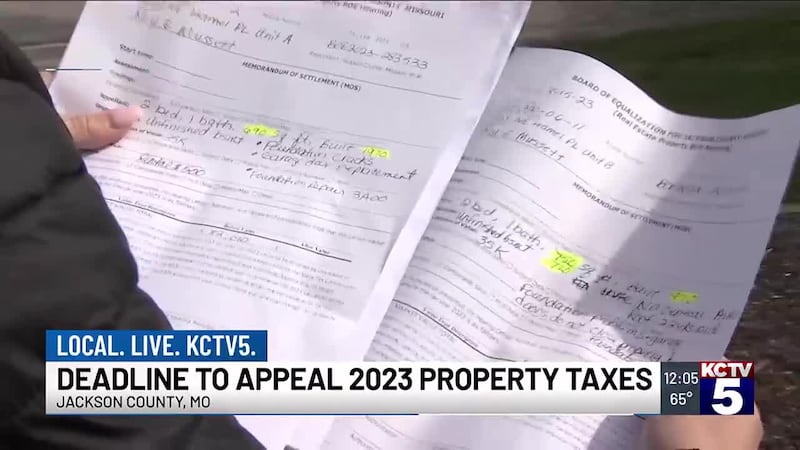

The trial centers on whether the State Tax Commission order that Jackson County limit assessment increases for 2023 and 2024 to 15 percent in most cases is legal.

Jackson County has not complied with the order, claiming the Tax Commission doesn’t have the authority to take that action.

In opening arguments this morning, the county argued that the tax commission approved the county’s assessment plan, but didn’t supervise the assessment. The county claims that capping the tax at 15 percent creates inequities and would force the county to raise the levy. The county said it would be “Robbing Peter to pay Paul.”

PREVIOUS COVERAGE: ‘Every hearing something new comes up’: Judge expresses frustration in 2023 Jackson County property tax case

The state argued that the assessment was flawed and that the county didn’t follow the law. Lawyers for the state noted that 200,000 properties had more than a 15 percent increase in assessment and that only about a quarter of the affected property owners were notified or had a physical inspection.

Gary Romine, chairman of State Tax Commission testified that the commission did not have confidence in the assessment.

Romine noted that they looked at the unprecedented number of complaints from taxpayers, the Jackson County Legislature questions, Kansas City Mayor Quinton Lucas’ frustration, a presentation from data expert Preston Smith and media reports.

Romine said that it was clear it was their responsibility to hand down the order. Romine said that their goal in filing the order was to protect Jackson County taxpayers.

A few taxpayers were in the courtroom to watch the proceedings. They expressed surprise that the courtroom wasn’t packed.

“You should come down here and show the judge that you care, don’t complain about it later when you lose your house, complain about it now,” said Elizabeth, who didn’t want her last name used for fear of retribution by the county. “I came down here because I’m not going to have a roof over my head.”

This is the second trial on the issue. A trial last summer was dismissed three days into it, at the request of Missouri Attorney General Andrew Bailey. He asked for the case to be dropped after the State Tax Commission order, claiming the order made it unnecessary.

The trial is expected to last three days.

ALSO READ: Long road ahead for tenants without heat at Raytown senior living apartments

Copyright 2025 KCTV. All rights reserved.