Jackson County Executive to decide fate of elected assessor ballot measure

KANSAS CITY, Mo. (KCTV) - Jackson County voters could get a chance to decide whether the position of assessor should be elected instead of appointed, but it will only happen if Jackson County Executive Frank White allows it.

On Monday, the legislature adopted an ordinance that would put the question to voters on the November ballot. The vote was 5-to-4. It’s not enough votes to be veto-proof, but due to the drawn-out process, the timeline itself would be enough to kill it.

White now has 10 days to sign or veto. That gives him until Aug. 29. The Secretary of State’s deadline to have ballots certified is Aug. 27. The question cannot be placed on the ballot until White signs the ordinance.

Monday night, he sent a statement articulating a number of concerns about making the position an elected one. The concerns included whether the popularity would outweigh expertise and that it would remove the checks and balances currently in place for the legislature to approve an appointment. He would not say yet specifically if he intends to sign or veto, but his list of concerns could be taken as a signal that he will not allow it to go forward.

Five legislators voted in favor of placing the language on the ballot: Donna Peyton, Manny Abarca, Venessa Huskey, DaRon McGee and Sean Smith.

“We’re the only county in Missouri that doesn’t have an elected assessor, and we’re the only county where we’re having this nightmare of a tax problem year after year after year,” said Smith. “I would say if we know what we’ve been doing isn’t working, then we should try something else, and an elected assessor is trying something else.”

Vice-Chair Megan Marshall voted no, along with Chair Jeanie Lauer, Jalen Anderson and Charlie Franklin. Marshall said her concern stemmed from what she described as a subversion of the longstanding process of changing the county charter. Typically, a series of recommended changes to the charter go on the ballot after a charter review commission, appointed by the county executive, looks through the charter from front to back.

“I just think, as part of good governance, making individual amendments to the charter without having a board look at and see how one thing impacts another thing, we’re just kind of doing reactive government,” Marshall said. “I think it’s probably time to do a charter review and that’s something we should really look into during next budget season.”

Abarca dismissed her concern as disingenuous because the authority of charter review begins with the executive. The county charter does specify that a charter review must take place no less than once every 10 years. The most recent changes were made in 2018.

“She very well knows that the county executive has to start that process,” Abarca said. “The county executive, in this scenario, is not going to start a process for which the outcome impacts his staff that he appoints. So, it’s just an excuse and a nice red herring that we can chase.”

SPARRING OVER ASSESSMENTS

Things used to be pretty mundane on the second floor of the Jackson County Courthouse every Monday when the county legislature met. That changed when lawmakers began arguing about Jackson County’s contentious 2023 property assessments. Five members have repeatedly butted heads with the other four and the county executive.

Legislator Sean Smith submitted a non-binding resolution directing the county counselor not to appeal the STC ruling. It also had provisions related to overall litigation decisions. The county’s lawyers expressed concerns. Lauer refused to read the resolution.

On Monday, Smith presented a softened resolution phrased as a request. It passed with Lauer and Anderson voting no, Franklin being absent for the vote (although present for the rest of the meeting) and Marshall abstaining.

Marshall then submitted her own resolution requesting that the assessment appeals process be re-opened for a period of 60 days after the assessment department provides a list of property owners who believe their assessment is inaccurate and have not yet filed an appeal or accepted a settlement.

“(It is) a request to work with the administration to identify and to help those homeowners who have fallen through the cracks, for lack of better words, and those are the ones who either haven’t appealed, they haven’t settled their appeal, and they are at most risk of losing their home,” Marshall said.

That resolution was assigned to a committee for further discussion.

TROUBLED ASSESSMENT HISTORY

White has repeatedly supported Assessor Gail McCann Beatty and defended the fairness of the assessment process. The assessor is responsible for managing the biennial property assessments. Beatty was handed the unpleasant task of bringing assessments in line with market value after they had long undervalued properties. Both the 2019 and 2023 assessment cycles prompted criticism.

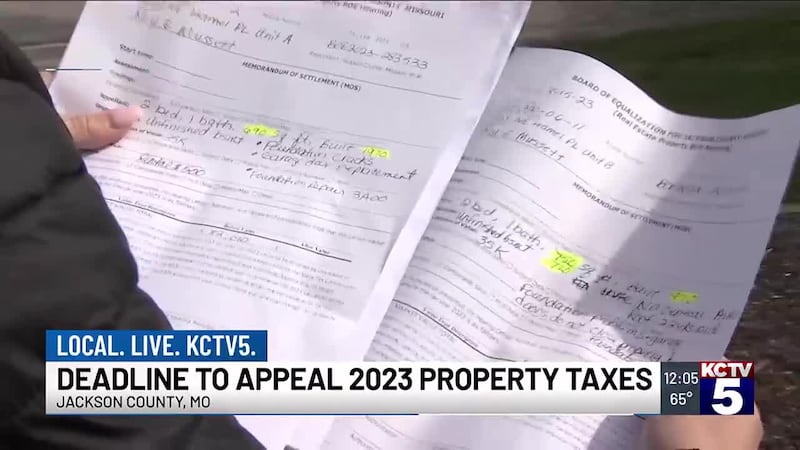

KCTV5′s Angie Ricono reported on several problems in 2023. She found that more than 500 homes of different sizes in different parts of town were all valued at exactly $356,270. She found a single neighborhood where inspections took an average of 41 seconds each.

Earlier this month, the State Tax Commission (STC) ruled that the county violated the law about required inspections and ordered the county to retroactively lower assessments to no more than a 15% increase from the previous year. The county’s chief lawyer, County Counselor Bryan Covinsky, said he intends to fight the order. He remarked that the STC “provided no reference to any investigation or review of facts or allegations.”

For more coverage on the Jackson County tax assessment trouble, visit this page.

Copyright 2024 KCTV. All rights reserved.