Court battle over Jackson County property taxes far from over

JACKSON COUNTY, Mo. (KCTV) - Despite claims of victory from County Executive Frank White, the court battles over the 2023 property tax assessment are not over.

One lawsuit has been dismissed, not on its merits, but because the state can’t go to court on the same subject as an earlier case since it was dismissed with prejudice.

That earlier case was a trial in June. Attorney General Andrew Bailey filed suit claiming the assessment was illegal. But a few days into the trial, Bailey asked for the case to be dismissed because, he said, a State Tax Commission order accomplished a fix.

The commission ordered Jackson County to correct the 2023 assessment and ordered increases in valuation to be capped at 15% for 2023 and 2024.

“There is a principle in the law known as “res judicata” that says, essentially, you don’t get two bites at the same apple,” explains Greg Allsberry, Chief Counsel for the State Tax Commission.

Allsberry said the state was forced to file a second lawsuit after the order because Jackson County refused to comply. “The Jackson County judge believed that….we had two bites at the apple.”

WHAT’S NEXT

Allsberry told KCTV5 Investigates that the state disagrees with the court’s dismissal order and they will be appealing.

“Significantly, the court did not rule that the State Tax Commission’s order regarding 2023 property tax assessments is invalid,” said Allsberry. “The Commission’s order is still a valid order, despite Jackson County’s refusal to comply. The Commission will continue to do all within its power to enforce its assessment order.”

ALSO READ: Missouri AG to sue Jackson County over gun ban on people under 21

But in a separate case, Jackson County has filed a legal challenge against the order, arguing that the move was highly politicized and goes beyond the agency’s legal authority.

There is a class action countersuit to the county’s action. It’s yet another legal avenue with the same arguments that the recent assessment was flawed and unlawful. The class action suit claims that thousands of Jackson County property owners are still waiting to be heard in court.

“I think it’s important to note that the court did not find that the order from the State Tax Commission is invalid, nor did it determine that increases above 15% were lawful,” said Jonathan Soper, in a statement. He’s the attorney representing taxpayers in the class action suit. “Those issues have yet to be decided. By pursuing counterclaims against the county, Humphrey, Farrington & McClain continues to push for answers to those questions, both for our clients and hopefully all property owners across Jackson County.”

TROUBLED ASSESSMENT

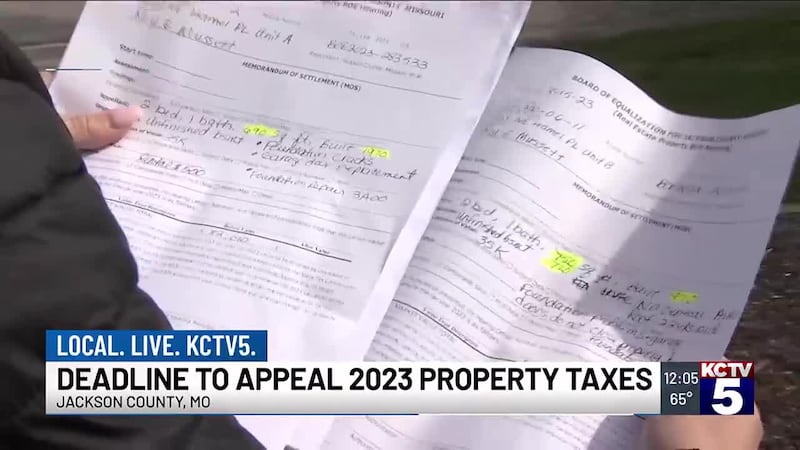

More than 55,000 appeals were filed by Jackson County taxpayers after the 2023 assessment. The state filed a lawsuit, claiming the county didn’t give property owners proper notifications of increase. It also claimed that the county didn’t comply with state laws requiring inspections when the assessed value increased by more than 15 percent.

KCTV5 Investigates did numerous reports with homeowners who described a broken process. They question whether physical inspections were actually done and many worry they’ll lose their homes as a result of the assessment.

Gail McCann Beatty, the County Assessor, has stood by the assessment.

“State law requires properties to be assessed at their true market value, which we’ve worked hard to achieve,” County Assessor Gail McCann Beatty told us previously. “While the process has been challenging, it’s essential for a fair and just tax system. This effort ensures that everyone in Jackson County is treated equitably, regardless of where they live, who they know or how much their home is worth.”

The county has long argued that the actions against the assessment are “politically motivated.”

ALSO READ: Jackson County leaders struggle to agree on issuing $70M in COVID funds as deadline nears

Copyright 2024 KCTV. All rights reserved.