‘Mind boggling’: Jackson County tax assessment data questioned as trial continues

KANSAS CITY, Mo. (KCTV) - Data analyst Preston Smith spent much of the day on the witness stand as the Jackson County tax trial continued.

The case is being heard by a Clay County judge who will decide whether to void or limit property values in the 2023 assessment.

The Missouri Attorney General and the State Tax Commission are suing Jackson County, claiming state laws were broken.

Smith was a key player in KCTV5′s ongoing coverage of the troubled 2023 assessment.

Smith was called an expert witness for the Attorney General’s office. He testified that his data showed numerous errors in the 2023 assessment and that his data showed the county’s claims about inspections being done was “impossible.”

READ MORE: Jackson County homeowners sound off on property tax assessments: “I don’t think anyone looked at my house”

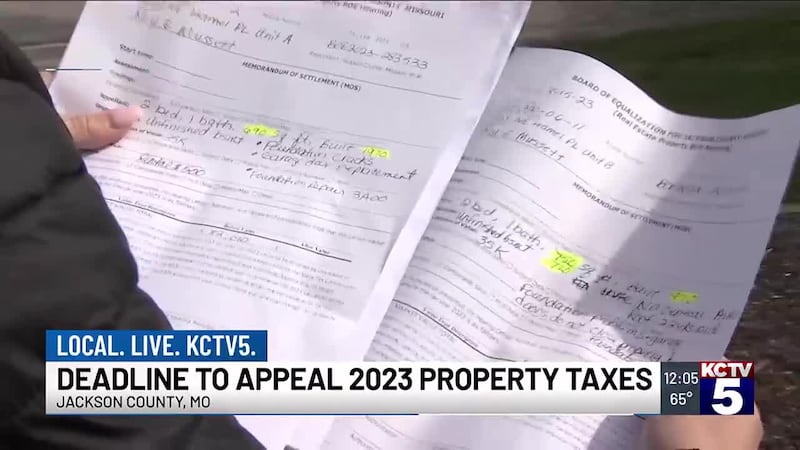

Smith said that by doing a frequency query, he found that 573 homes were valued at the same amount--$356,270 and there were huge differences between those properties.

That disparity was also the subject of several KCTV5 reports that showed some million-dollar homes, and vacant lots were given the same value.

Smith went on to say his findings showed problems with field inspection oversight, quality control and management.

He testified that the data system of Tyler Technologies, the third party vendor hired by the county, can’t “talk” with the data system the county uses, calling the discrepancies “mind boggling.”

Following his testimony, Smith said he is grateful for the opportunity to showcase his data.

“For the first time ever, we may be able to present clear evidence of what has happened in the assessment,” Smith said. “And for the first time ever the assessor is going to be under oath to show what she did and to explain to the people what’s been going on in this building.”

Monday afternoon, the Jackson County assessor, Gail McCann Beatty was on the stand and continued to defend the 2023 assessment.

MORE ON TAX ASSESSMENT TROUBLE FROM KCTV

She claimed data collections knocked on doors, and measured every property that had a value increase of 15% or more. She also agreed that they typically spent 10-to-15 minutes on each outside assessment.

A KCTV5 investigation showed county employees spent an average of 41 seconds at each property in one Independence neighborhood.

McCann Beatty also blamed interference from the public and legislators for creating much of the criticism surrounding the assessment. “No other county has faced this much interference from public and legislators,” McCann Beatty said in court.

McCann Beatty had no comment for waiting reporters as she left the courtroom today.

This was the third day of testimony and while the case was first planned to go just three days, it will continue on August 9. McCann Beatty will continue her testimony then.

Copyright 2024 KCTV. All rights reserved.