Jackson County property tax trial is underway as homeowner bills hang in the balance

KANSAS CITY, Mo. (KCTV) - A judge is now hearing testimony regarding the 2023 Jackson County property tax assessment. She’s being asked to void or limit property values meaning millions of dollars hang in the balance.

The Missouri Attorney General and State Tax Commission are jointly suing the county claiming state statutes were violated and that homeowners did not receive proper physical inspections if their values changed by more than 15%.

They point to a preliminary finding by the Missouri Auditor that state statutes were violated.

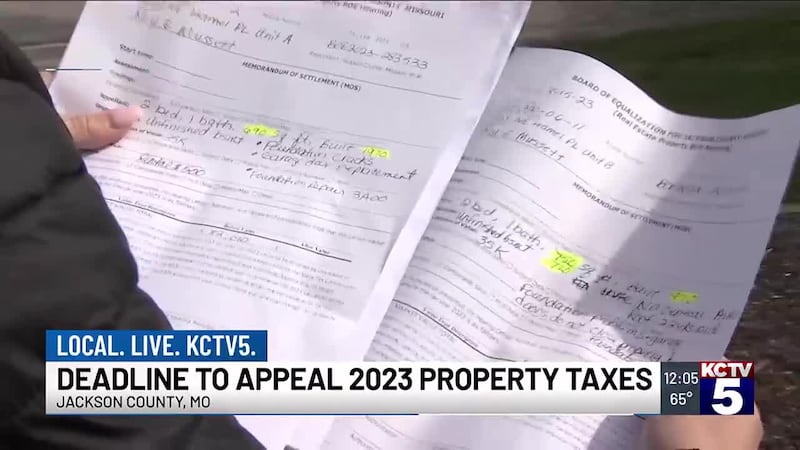

Attorneys for Jackson County argue the lawsuit was political in nature and homeowners have a way to solve a faulty assessment, simply appeal- no assessment is perfect. A record 55,000 homeowners have appealed their values.

State Tax Commission employees testify

Larry Jones with the Missouri State Tax Commission testified he reviewed records that show Jackson County spent less than a minute per property for physical inspections.

That’s similar to what a KCTV5 Investigation revealed inside an Independence neighborhood.

State law specifies inspections cannot be a drive-by or observation from a sidewalk.

Jones testified larger increases should include notifications to homeowners and the opportunity for interior inspections.

ALSO READ: Missouri Attorney General launches tip line for victims of Jackson County property tax assessments

Another state tax commission employee testified he was concerned about late notices. He also told the judge that other counties have not experienced such large increases and complaints from homeowners.

Former Board of Equalization employee testifies

A former BOE employee testified that the county attempted to find new comparable sales to justify higher assessments when homeowners appealed.

Kennedy Jones recalled homeowners with clear examples of lower sales that were ignored.

He referred to the new county values as “egregious.” Jones says taxpayers were ultimately defrauded and the process was stacked against taxpayers.

Jones testified a Tyler Technologies employee directed him to add 10% to any appraisal to help increase values.

Jones says he was wrongly terminated as he pushed back against policies he did not agree with. He also claims assessment director Gail McCann Beatty yelled at him as he defended homeowners.

Builder and Developer testifies

Lance Dillenschneider testified about a broken process he was forced to navigate. He told the judge he believes others fared much worse. He eventually hired a tax consultant even though he’s familiar with the assessment process.

He described sitting on the phone and letting it ring for three hours and no one ever answered.

Dillenschneider eventually showed up for unscheduled appointments to negotiate his assessments. He describes the 2023 assessment as 2019 on steroids.

He testified that he paid taxes under protest and decided to not appeal to the State Tax Commission because it’s so backed up due to the large number of appeals in Jackson County.

“It was a very one-sided situation for a one-sided purpose,” said Dillenschneider.

He told the judge a woman told him she’d have to make a choice between buying medicine and paying her taxes.

Other notes

The trial is expected to last three days.

Assessment Director Gail McCann Beatty was not present in the courtroom during Thursday morning’s hearing. Several county legislators stopped by including Manny Abarca who renewed calls for an elected assessor to ensure more accountability and fairness.

For more stories regarding Tax Assessment Trouble, click here.

Copyright 2024 KCTV. All rights reserved.