Frank White requests Missouri attorney general withdraw lawsuit over property tax assessment

KANSAS CITY, Mo. (KCTV) - In December, Missouri Attorney General Andrew Bailey, along with the State Tax Commission, filed a lawsuit against Jackson County over the 2023 property assessment.

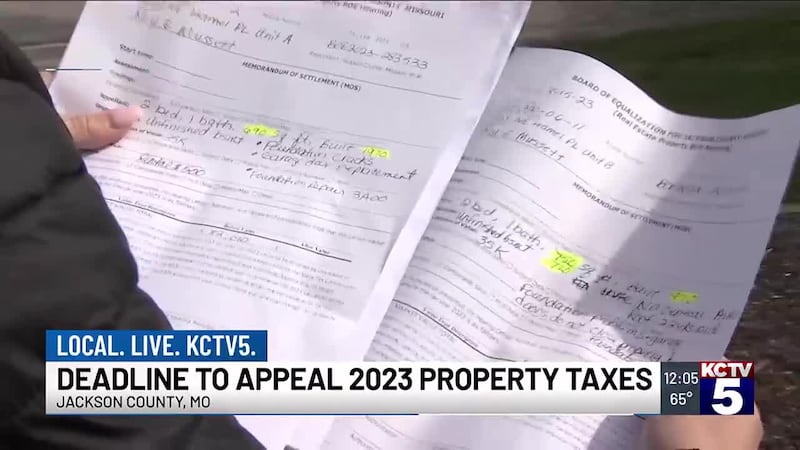

The lawsuit asked a judge to stop tax collection and declare almost all property increases as void. It also demanded monetary damages on behalf of some homeowners.

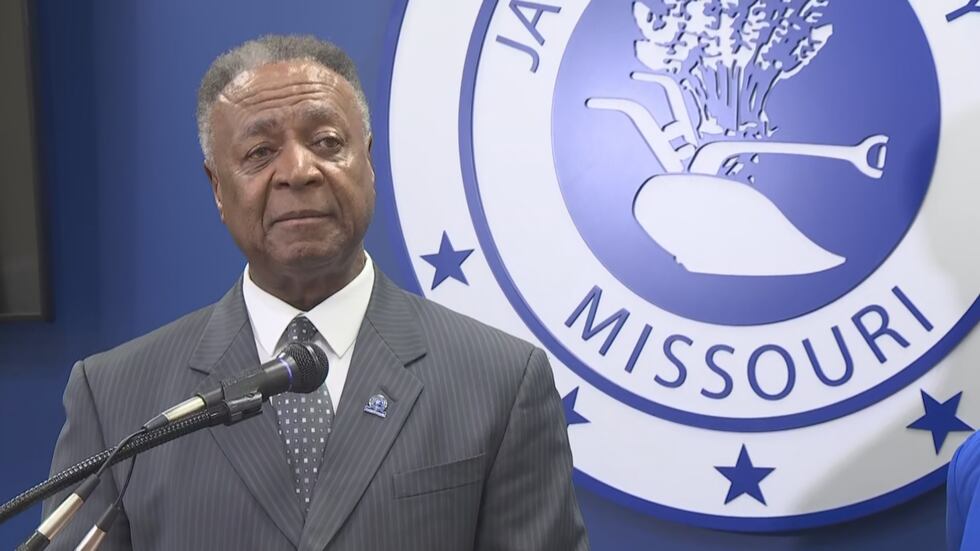

On Wednesday, Jackson County Executive Frank White called on Bailey to withdraw the lawsuit, citing financial risk for school districts and essential public services.

The lawsuit contended that the 2023 assessments were unlawful and the failures were systemic. It pointed to state laws that require physical inspections and proper notice of assessments.

White argued that the increase residents have seen in the 2023 reassessment “were a combination of economic changes that have significantly increased home values and years, if not decades, of inconsistent and unfair property assessments in Jackson County that tended to have more to do with who you know than how much your property is worth.”

The county executive stated that should the 2023 assessment be rolled back to its 2021 values, the following school district would need to repay certain amounts in 2023 property taxes:

- Fort Osage: $5,958,243

- Independence: $16,083,539

- Lee’s Summit: $31,867,939

- Oak Grove: $2,708,338

ALSO READ: What one neighborhood reveals about Jackson County assessment inspections

Bailey’s lawsuit contended that illegal assessments resulted in at least a 30 percent average increase in real property values and that many Jackson County real property owners received increases greater than 100 percent.

“A court has already found that Jackson County’s assessments ‘failed the citizens,’ were ‘inaccurate,’ and that there was a ‘lack in leadership and preparation of Jackson County officials.’ The evidence in this case is overwhelming, which is why I’m confident in our ultimate success on the merits,” AG Bailey said in a statement. “My office has put in long hours on this case, and we will not stop until we’ve achieved justice for all Jackson County residents.”

The AG’s Office also noted it has received a total of 968 submissions to the tip line since it was launched. That does not include complaints received from Jackson Co. residents before the tipline was set up.

For more stories regarding Tax Assessment Trouble, click here.

Letter to the Attorney General by Greg Dailey on Scribd

Copyright 2024 KCTV. All rights reserved.