Jackson County’s second property tax trial continues into second day

KANSAS CITY, Mo. (KCTV) - The trial over the 2023 tax assessment is on its second day.

The case centers on whether the State Tax Commission’s order limiting increases in assessment value to 15 percent is lawful.

In testimony Wednesday, Maureen Monaghan, deputy director of the Jackson County Assessment Department defended the assessment and explained the appeal process.

Monaghan testified that with very few exceptions, every property in Jackson County had a physical inspection. She noted that taxpayer complaints are common.

She said that prior to this assessment, property values in Jackson County were undervalued. The goal of the assessment was to bring properties up to market value.

The tax commission has testified that they had a responsibility to issue the order after hearing from taxpayers, legislators, and media reports about the troubled assessment.

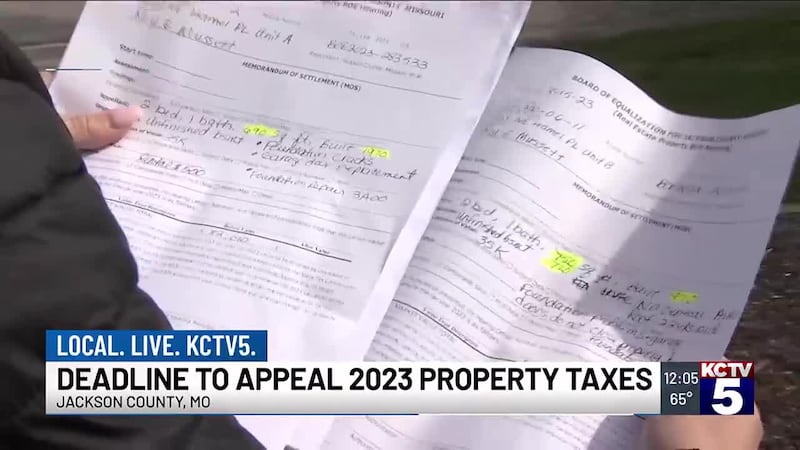

Amy Corn, a real estate agent who helped several property owners file appeals was in court today to watch the proceedings.

“As a taxpayer that has fought debilitating property tax increases. I wanted to be here to show support of the commission’s order,” said Corn. “The was a relief for those of us fighting an uphill bureaucratic battle.”

She expressed frustration that the county is trying to go around the legal checks and balances in place to protect taxpayers.

Late in the day, data expert Preston Smith took the stand. Smith was interviewed several times and was included in KCTV5′s ongoing reporting of the assessment.

He presented to the state tax commission last summer about what he called critical errors in the assessment. Following the presentation, the commission ordered Jackson County to cap increases in assessed value to 15 percent.

The final witness on Wednesday was Kennedy Jones. He’s a former hearing officer who presented to the State Tax Commission.

Jones testified that hearing officers were pressured to increase assessment values.

Jones testified that he told commissioners that the comparables assessors used were dissimilar and that assessors wouldn’t use comparables that favored taxpayers.

He said he thought assessors were against doing the right thing.

Jones described a “hostile” environment for those who disagreed with assessors. He testified that when he tried to take a case to County Assessor Gail McCann Beatty, she told him he was “crap” and to get out of her office.

Jones was eventually fired.

The trial continues tomorrow.

Copyright 2025 KCTV. All rights reserved.