Class action lawsuit claims thousands of Jackson Countians await answers in tax assessment case

JACKSON COUNTY, Mo. (KCTV) - Just as property tax bills hit Jackson County homeowners’ mailboxes, there’s another legal challenge over the 2023 Jackson County property tax assessment.

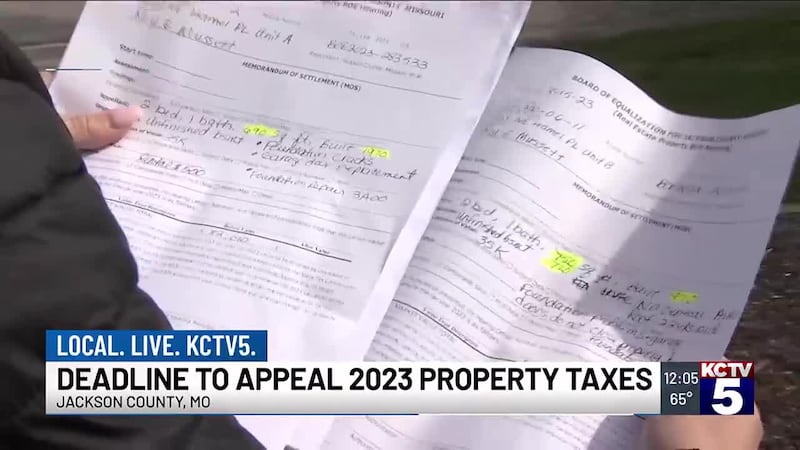

A Jackson County attorney has filed a class action countersuit claiming thousands of Jackson County property taxpayers are still waiting to be heard in court.

It’s yet another legal avenue with the same arguments that the recent assessment was flawed and unlawful. An earlier class action suit was thrown out, not because of merit, but on procedural grounds. The court ruled that taxpayers must first appeal to the Board of Assessment, then the State Tax Commission (STC) before filing suit. Thousands of taxpayers did that.

In August, the STC ordered the county must limit assessment increases in 2023 and 2024 to 15 percent in most cases.

READ MORE: Frank White’s foes in legislature reveal new effort in property tax battle

The county challenged the STC order, claiming it was filled with inaccuracies and was “dangerously politicized.”

But Jonathan Soper, the attorney filing the class-action suit on behalf of hundreds of taxpayers disputes that.

“I don’t see it as a political issue at all,” said Soper. “I see it as property owners—no matter who they support or whose signs they put in their yards during election season—should not have to pay unlawful taxes.”

Nearly 55,000 appeals were filed over the 2023 assessment—a record.

KCTV5 Investigates spent months looking into the troubled assessment and questioned whether physical inspections were done. KCTV5 revealed a data error the county later admitted was a mistake.

For more on the tax assessment trouble in Jackson County, click here.

Copyright 2024 KCTV. All rights reserved.