Jackson County: State tax order does not impact refunds for taxpayers who paid under protest

JACKSON COUNTY, Mo. (KCTV) - After Monday night’s meeting, some Jackson County legislators are searching for solutions following the Missouri State Tax Commission order while taxpayers continue to ask questions about when they could see change.

Last week, the Missouri State Tax Commission (STC) ordered the county must limit assessment increases in 2023 to 15% in most cases.

On Monday night, Jackson County Legislator Sean Smith submitted a resolution directing the county counselor to not appeal the STC ruling.

The resolution also included an instruction that the legislature have input on any lawsuit over $5,000.

It didn’t make it to the first reading. Legislative Chair, Jeanie Lauer rejected it due to concerns about whether it was legal.

“I think there was a majority of legislators who agreed we should not challenge the result of the State Tax Commission and allow it to stick,” said Jackson County 1st District Legislator Manny Abarca.

READ MORE: Jackson County lawyer: One way or another, court order on assessments will be challenged

On Tuesday, Legislator Smith said there are $119 million in overpayments by Jackson County taxpayers and they need to act fast.

“We have six weeks to fix this before the problem gets twice as bad because that is when cities and school districts set their levy rates,” said Jackson County 6th District Legislator Sean Smith.

He said it could turn into a $250 million problem if resolutions are delayed.

Legislator Smith wants to see the county comply with the STC and feels there are two viable solutions to mitigate the issue and create a win for everyone.

“I think we made a mistake and I think we need to pony up some of the money to help fix people who are in an immediate financial crisis,” said Smith.

He said another option he plans to bring forward is to help both the taxpayers and tax jurisdictions.

“If we follow the state tax commission’s order, recalculate people’s assessed values, and provide that information to the taxing jurisdiction they can then set their levy rates properly,” said Smith.

READ MORE: Homeowners worry they’ll lose their home because of 2023 property tax assessment

There, jurisdictions could account for money they might have lost, but due to this, he said levy rates may bump up a little bit.

“Bottom line is if we do that over a couple of years and then we allow people to take a credit for a couple of years on their tax bill if they overpaid then we kind of smooth this out,” said Legislator Smith.

These have not been introduced yet.

While Legislator Smith and Legislator Abarca among their colleagues work to find solutions, some taxpayers brought their questions to KCTV5.

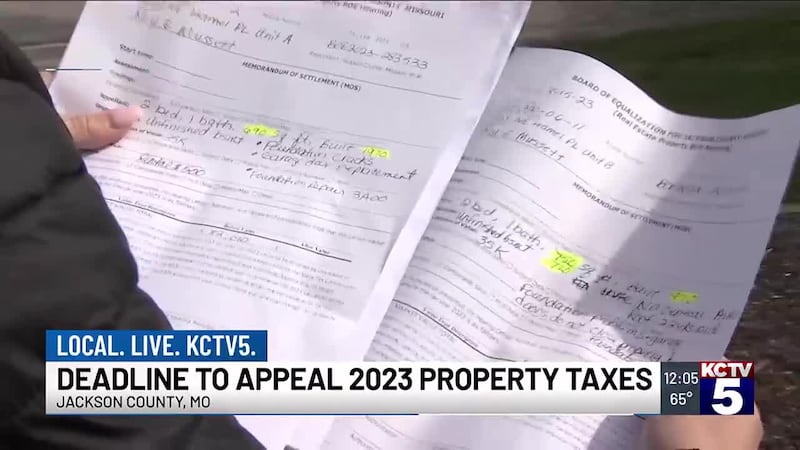

One asked about paying under protest and what that means for them.

Legislator Smith said many people might think they did this and added writing a memo on your check saying ‘paid under protest’ does not make it valid.

“You have to fill out certain forms and it depends on which form whether you have a mortgage and you pay your taxes that way or directly and then you have to be a part of a lawsuit there was a lawyer here in town that was doing that for free and she added their names to that suit all of that had to take place,” said Legislator Smith.

He said the Jackson County Tax Collector is looking into the exact number of how many paid under protest.

Legislator Smith believes the money set aside would be about a few million.

On Tuesday, Jackson County Executive’s Office provided a statement regarding paying under protest:

“The STC order does not impact refunds for payments made under protest. Tax payments properly made under protest go into a separate account. A tax payment is properly made under protest if the taxpayer files an STC appeal or a lawsuit. If a lawsuit has not been filed by the taxpayer within 90 days, those funds are scheduled to be distributed to the jurisdictions.

At this time, the monies paid under protest sitting in the separate account should either be properties still under an active STC appeal or involved in an active lawsuit. All other monies have been released back to the jurisdictions.

Any taxpayer who paid their taxes and then receives a property value reduction from the result of an appeal will be refunded.”

While Mayor Quinton Lucas doesn’t play a major role in this, as a resident and taxpayer he said all they want is clarity.

“We don’t need more saber rattling, but we need the solutions. We need an outcome. And I think we need an understanding that this was a tough process for many people around here,” Lucas said. “How can we do different? I was somebody whose taxes were increased, I think 67% and a whole bunch of people had a whole lot worse. We need to make sure that these types of harms don’t happen again. I think there’s a way you can resolve it.”

Legislator Smith plans to re-introduce his resolution next Monday.

Copyright 2024 KCTV. All rights reserved.