Detailing what happens next in the crisis over Jackson County property taxes

KANSAS CITY, Mo. (KCTV) - It’s been days since the Missouri State Tax Commission (STC) put its proverbial foot down on the Jackson County property tax assessment, but it seems it is no closer to a resolution with the county.

The STC ordered the county to correct the 2023 assessment and ordered increases in valuation be capped at 15% for 2023 and 2024.

The order is seen as vindication for many taxpayers hit with unexpected, and shockingly high assessments.

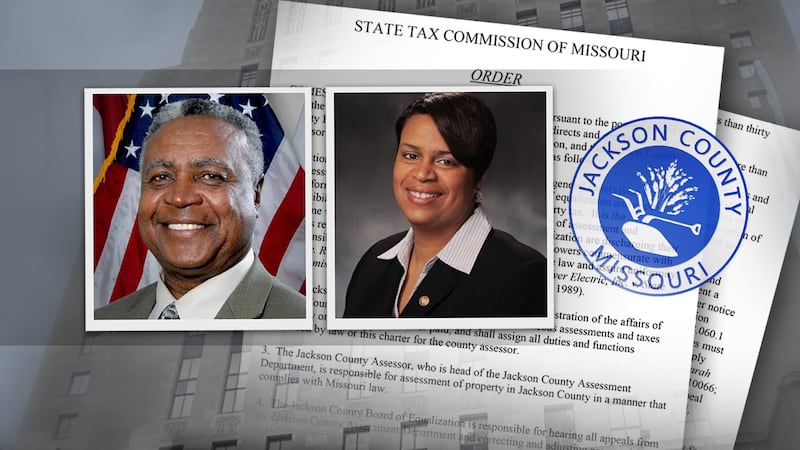

The county administration has vowed to fight the order, calling it politically motivated. County Executive Frank White and Assessment Director Gail McCann Beatty declined in-person interviews and spoke only through media releases.

But not everyone inside the county agrees with fighting the order.

On Thursday, several Jackson County legislators held a news conference pledging support for the STC and the order.

“The administration has put out press releases and they say things like, ‘Jackson County unequivocally rejects the state tax commission,’” said Jackson County Legislator Sean Smith. “Well, let’s be honest. As a legislative body, we are part of Jackson County. They’ve done this again without consulting us.”

The legislature meets every Monday. Smith said he will introduce legislation that would prohibit county attorneys from using taxpayer resources to fight the order.

“The reality is that we all need to focus now on getting this fixed,” said Smith.

Right now, the tax commission order is the only “fix.” The lawsuit that Missouri Attorney General Andrew Bailey and the STC filed -- that was underway in Jackson County -- was dismissed after the STC order--at the request of Bailey.

Bailey argued that the commission’s order accomplished the same goal as the lawsuit.

Two attorneys weigh in

To say what’s been happening in Jackson County over the last year is unusual would be an understatement.

“None of us who work in this field has ever seen any order like this,” said Bob Murphy, a tax attorney and former Jackson County assessor. “In recent times, there have been times when the state tax commission has ordered a county, almost always a rural county, to increase their assessments. Nobody has ever seen an order like this.”

He also told us that the county vowing to fight the STC is unprecedented.

“I don’t know of any county assessment department that has ever thought that the directions of the state tax commission are optional anywhere in Missouri,” said Murphy.

Another attorney KCTV talked with said the county may be fighting a losing battle if it goes against the order.

“In terms of the authority, I think the law is pretty clear that the state tax commission does have the authority to issue orders like this,” said Jonathan Soper. He was the original attorney in a class action lawsuit filed over the 2023 assessment.

Soper said in the end, taxpayers are the losers in the fight.

“Property owners don’t care about the politics here,” said Soper. “They just want not to have to pay unlawful and illegal taxes. And so, I’m not really concerned about the politics, I’m concerned about helping folks get a tax bill that’s fair.”

Are politics at play?

Jackson County openly “rejects” the STC order calling it “inaccurate and dangerously politicized.”

Many speculate the new chain of events took place because Bailey was scheduled to be deposed about conversations he had regarding the trial.

Because the lawsuit has been dismissed, the deposition will not take place.

KCTV5 reached out to Bailey’s spokesperson Madeline Sieren about the allegations. She dodged the direct question but provided an answer about the order.

“Pushing the lawsuit forward could have jeopardized the much-needed relief offered in the Tax Commission’s order and would be counterproductive for Jackson County taxpayers,” wrote Sieren.

Dismissal of the lawsuit means Tyler Technologies no longer faces potential monetary damages. That company was paid $17.9 million in taxpayer money to help run a competent assessment.

Assessment Director Gail McCann Beatty is also spared full questioning under oath.

KCTV5 pushed for answers from the State Tax Commission too. Why go through litigation if an order was always an option and the ultimate answer? We were provided with this statement:

The Commission reached its decision to issue an Order after examining a substantial amount of information which it has acquired over the last few months, including but not limited to County assessment records and sworn statements of County officials which it obtained through discovery in its lawsuit against Jackson County.

2023 assessment - Was it that bad?

Nearly 55,000 appeals were filed in Jackson County. That’s a record.

The State Auditor is still reviewing the entire assessment process.

In December, the auditor revealed problems with state-required physical inspections and required notifications.

There was a push for a 15% cap before taxpayers ever paid property tax bills. That never happened.

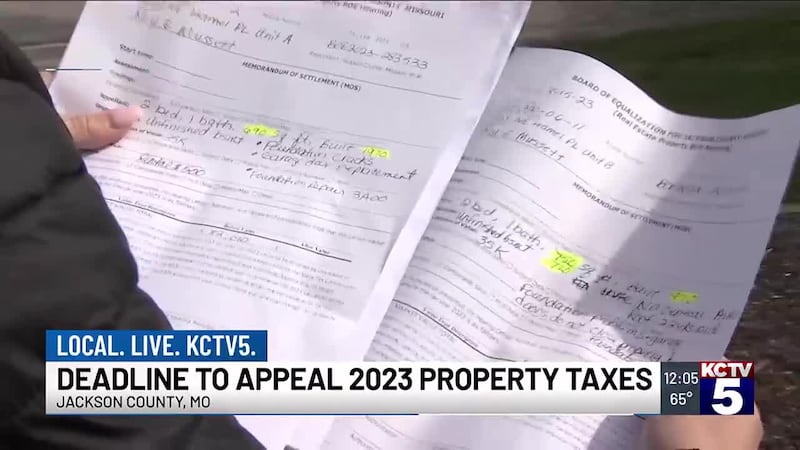

KCTV5 has documented concerns from homeowners facing shocking new values. Many question the quality of the work that led to higher property tax bills. Homeowners brought forward example after example of a sloppy assessment.

KCTV5 revealed a data error the county later admitted was indeed an error.

Numerous municipalities sued Jackson County saying the problematic assessment meant they could not set appropriate levies.

Jackson County stood firm saying any individual property owner could appeal an incorrect value.

But the appeals process was plagued by problems too as homeowners reported feeling strong-armed by hearing officers and confusion regarding appointments.

Jackson County’s troubled assessment had more news coverage than any other topic in 2023- “Tax Assessment Trouble.”

What’s at stake?

Jackson County’s media releases point out schools have a lot to lose if assessments are capped at 15%.

Money from last year’s property tax bills have been collected and dispersed. Schools have spent the money or already allocated those funds for the upcoming school year.

READ MORE: ‘Devastating’: What rolling back property tax assessments could mean for schools

On the other side, homeowners say the process was unfair and the county must follow the law. Advocates describe what happened to homeowners as shameful.

“‘One thing that breaks my heart is that there are so many homeowners that had to sell their homes, they had to sell their properties as a result of the flawed assessment,” said Stacey Johnson Cosby. “And there’s no coming back from that. What do they do?”

Homeowners are left wondering how quickly they could be refunded or see their mortgages adjusted.

“If it goes through, it’ll help me considerably as I’m sure many other residents in the city. But I know Frank White and the county, they’re going to fight this thing tooth and nail,” said Tim Bullock.

Legislators and attorneys all warn the process will likely drag on and there’s no giant pot of money to issue refunds.

Copyright 2024 KCTV. All rights reserved.