Judge dismisses Jackson County property tax lawsuit

KANSAS CITY, Mo. (KCTV) - The legal case involving Jackson County property taxes has been dismissed by a judge.

On Wednesday, the Missouri Tax Commission ordered that the county must limit 2023 assessment increases to 15 percent and that assessed valuation for 2024 properties will stay the same as 2023.

That order, according to Attorney General Bailey, accomplishes what the lawsuit set out to do and last night, he asked for the case to be dismissed.

On Thursday morning, the judge in the case agreed.

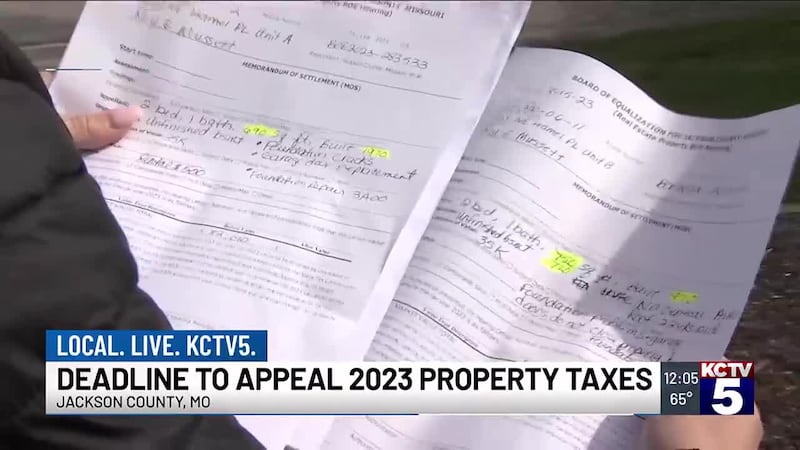

The lawsuit, and the order by the tax commission, claimed the county did not give property owners proper notification of increases, and that the county did not comply with state laws requiring inspections with the assessed valuation of a property increased by more than 15 percent since the last assessment.

ALSO READ: Homeowners call Jackson County Assessor liar following testimony in tax assessment trial

Throughout the litigation, the county has claimed the lawsuit was politically motivated.

The entire process has been confusing for property owners, many of whom have complained about the recent assessment. In fact, a record number of appeals were filed—nearly 55,000.

All of this is unprecedented.

On Thursday afternoon, two county legislators will have a news conference to talk about the next steps for the county and property owners.

ALSO READ: Jackson County homeowners sound off on property tax assessments: ‘I don’t think anyone looked at my house'

The big winner in the lawsuit dismissal may be Tyler Technologies, the third-party vendor hired to help run the 2023 assessment and to help with informal reviews. The company’s contract with Jackson County was approximately $17.9 million.

The lawsuit claimed Tyler Technologies did not perform all parcel-by-parcel reviews and when reviews were done, they generally consisted of taking photos. The lawsuit claimed Tyler Technologies failed to meet deadlines, its representatives were not trained, and the company made false promises. The suit claimed it failed in its duty to perform the services it was contracted for.

The dismissal of the lawsuit relieves the company of accountability.

RELATED: KCTV5 Special Report: Tax Assessment Trouble

Copyright 2024 KCTV. All rights reserved.