Lawsuit over Jackson County tax assessments to get its day in court

KANSAS CITY, Mo. (KCTV) - Despite the county’s efforts to have the case thrown out, the lawsuit over the latest Jackson County property tax heads to court on Thursday.

This involves the lawsuit filed by the Missouri Attorney General and the state Tax Commission claiming laws were broken. They are asking a judge to void the increases property owners paid.

Named in the suit are Jackson County, County Executive Frank White, Assessment Director Gail McCann Beaty, and third-part vendor—Tyler Technologies.

How we got here

It’s an unprecedented lawsuit with massive implications.

This assessment was troubled. KCTV5 Investigates has done dozens of reports over several months because the assessment and the process to fight back were both broken.

Scores of taxpayers contacted us because they said they had nowhere else to turn.

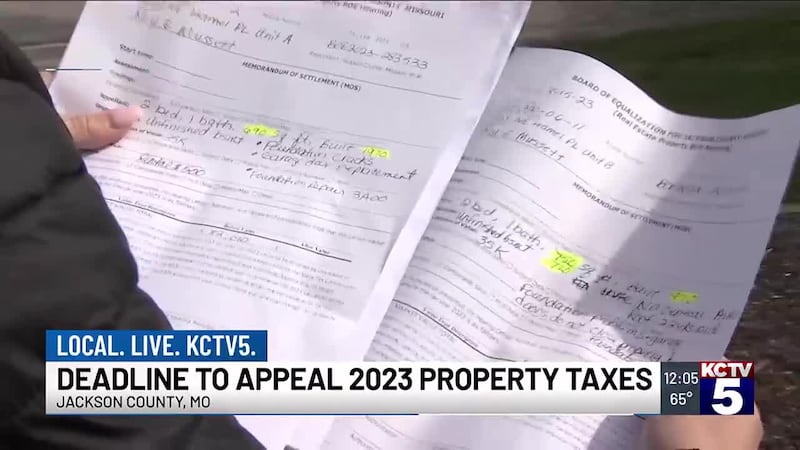

Problems were evident from the beginning. The lawsuit summarized the assessment this way:

Jackson County’s 2023 assessments were not only unlawful, but the failures were systemic—from failing to provide proper notice and inspections under the law to coercing property owners to drop their appeals.

The question of physical inspections

We’ve challenged the county’s claims on thorough physical inspections.

Despite numerous requests, Assessment Director Gail McCann Beatty refused to talk with KCTV5 about physical inspections.

But she did respond to legislators during a meeting and explained how tape measures were used for inspections.

When asked by a legislator how homes were measured, she replied, “What do you mean, how do we measure? You take a measure tape and you hook it on one corner of the house and go to the other corner of the house.”

But homeowners we talked with said that never happened.

The lawsuit heading to court argues physical inspections are required under the law. It specifically points out that “drive-by” inspections are not sufficient.

We studied pictures with timestamps from one Independence neighborhood. We found that 52 inspections were done in 36 minutes — that’s 41 seconds per property.

READ MORE: What one neighborhood reveals about Jackson County assessment inspections

What’s next

As late as last month, County Executive Frank White asked for the lawsuit to be thrown out. White claims it’s “a political attack” and potentially devastating for school funding.

But the case moves forward; it’s set to be heard starting on Thursday.

KCTV5 will be in court as a judge listens to evidence and rules on the tax increases. Property owners have already paid, the Attorney General and the State Tax Commission want to void the increases, and want Tyler Technologies to be fined for not doing a proper job.

The original lawsuit can be found below.

Copyright 2024 KCTV. All rights reserved.